Time for a couple weeks of vacation

Reflections on Harrisburg, Pennsylvania real estate, life, motorcycling, travel, politics, land, building, food and anything else that strikes my fancy

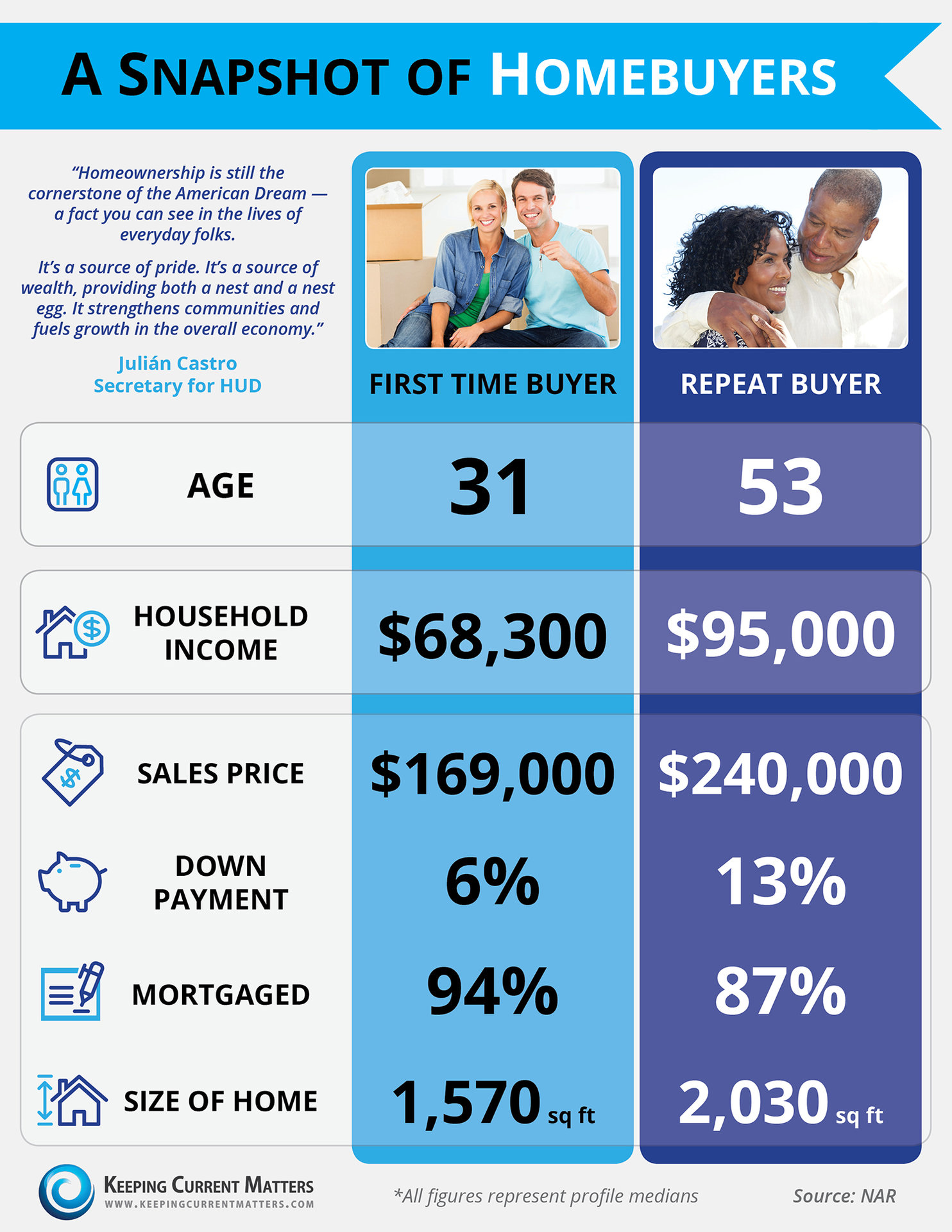

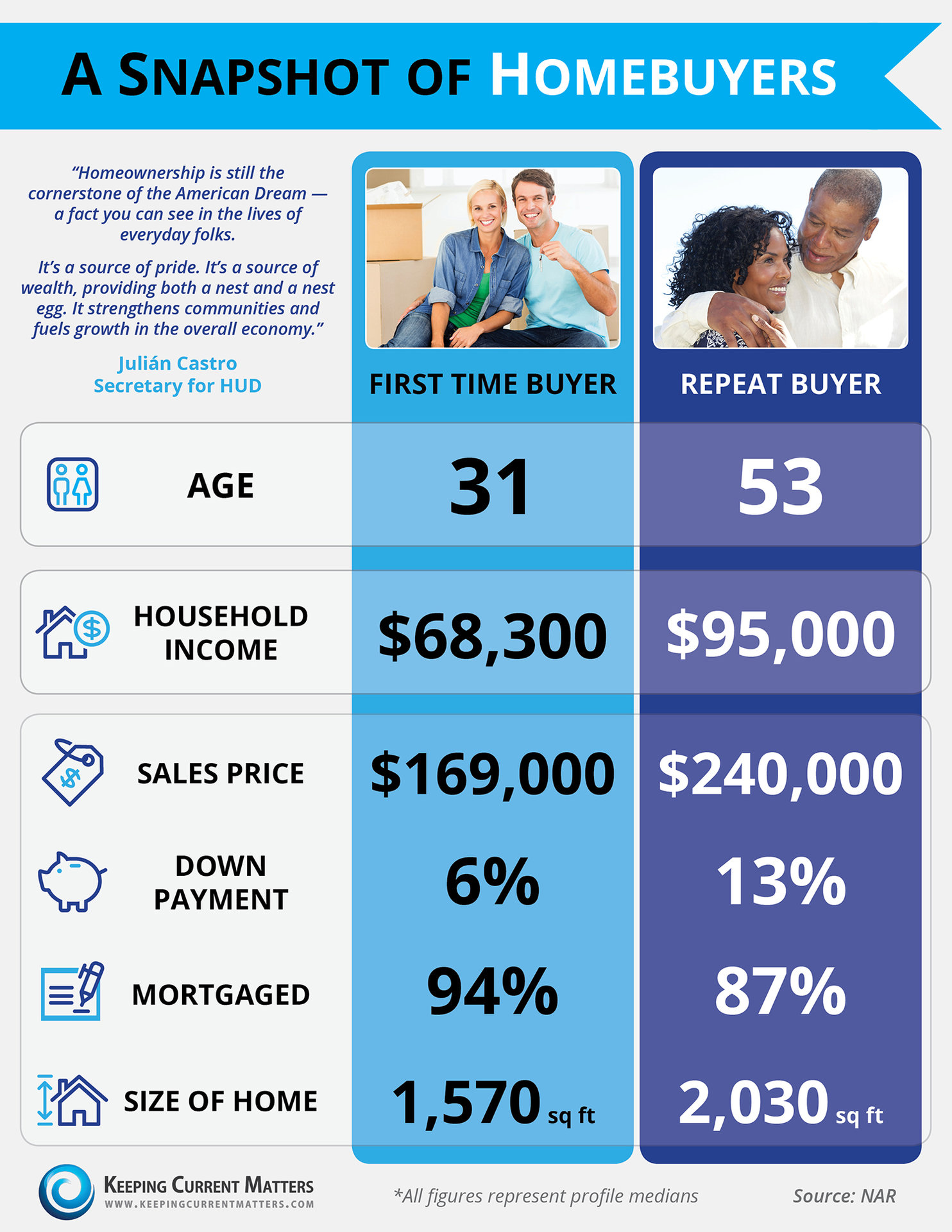

“It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment.It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added)

“Depending on their credit history and other factors, many borrowers can expect to make a down payment of about 5 to 10%. And new 3% down financing options for qualified borrowers could mean a down payment as little as $6,000 for a $200,000 home.”